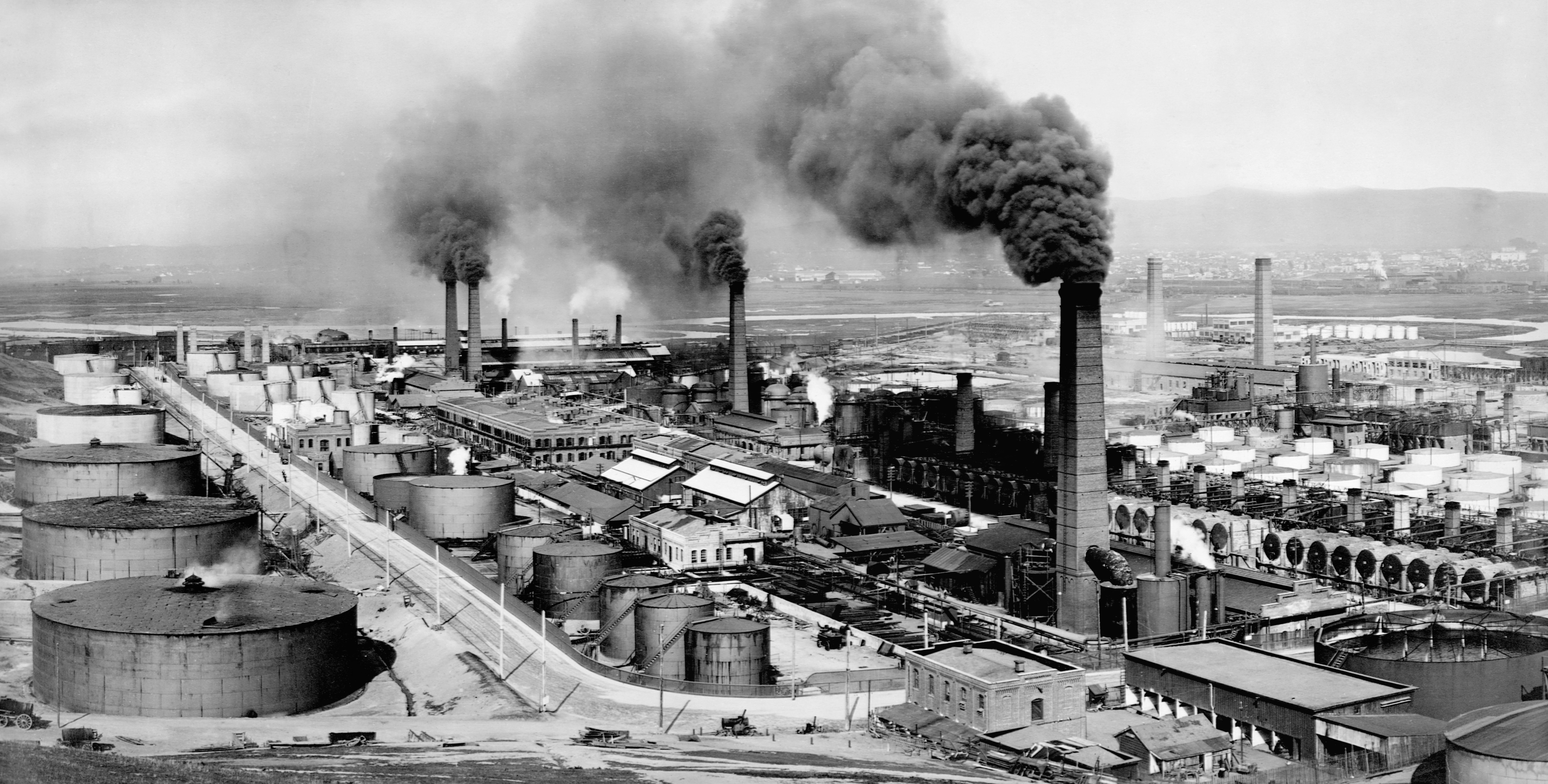

It was almost a century ago when John Rockefeller crowned oil as the standard of American energy, with his aptly named company, Standard Oil. Three generations later, his family is veering away from the very industry that made them billions, with the announcement that their charitable organization will divest from fossil fuel companies.

The charity, called the Rockefeller Brothers Fund, was launched in 1940 by Rockefeller’s sons to “to advance social change that contributes to a more just, sustainable, and peaceful world,” according to the organization’s website. It owns $860 million in assets. With its move to divest, the philanthropic organization is joining hundreds of other institutions and investors—including the World Council of Churches and actor Mark Ruffalo—in pulling their money out of fossil fuel investments.

The Rockefeller Brothers Fund plans to realign its finances in coal and tar sands by the end of 2014. The board of trustees is working on a strategy to divest from other fossil fuels within the next few years.

With more companies joining the divestment coalition, the battle against fossil fuels continues to build and diversify. According to an article in The New York Times, the total movement is now worth $51 billion. Stephen Rockefeller, great grandson to John Rockefeller and trustee of the Rockefeller Brothers Fund, tells the Times that there is a "moral and economic dimension" to divestment.

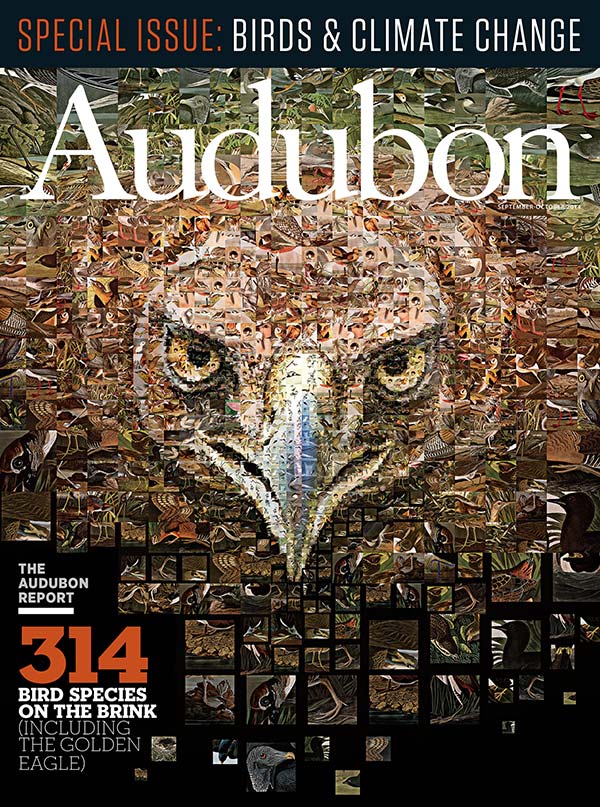

In an interview with BBC, Chairwoman Valerie Rockefeller Wayne says “there is a moral imperative to preserve a healthy planet.” She is not alone in that thinking. Back in May, Stanford University made headlines across the nation (including in Audubon's climate change issue) by pledging to sell off all of its stocks in coal. Last week, a multi-billion-dollar pension fund in Australia promised to limit its investments in coal as well.

Despite the growing numbers, the divestment movement is still largely a symbolic act rather than a true danger to fossil fuel companies’ financial health. As Matt Yglesias explains in Vox, refusing to invest in fossil fuels doesn’t really affect companies’ bottom lines, as there are still plenty of people willing to make the bet that these energy giants will be profitable. Yglesias points out that the companies aren’t that reliant on external funds. But the growing momentum the press generates helps to convey the real point of divestment—signaling disapproval.

A similar tactic of divestment was employed against South African companies in the 1980s, and is credited with successfully applying pressure on the country to end apartheid.

The Rockefellers’ divestment announcement coincides with the United Nations’ Climate Summit, which is being held in New York City this week. More than 100 world leaders have gathered to discuss international goals for sustainability, in preparation for next year’s Climate Change Conference in Paris.

Top paragraph: Oil, and the American demand for it post Industrial Revolution, is what catapulted John Rockefeller and his family to fame and fortune. The image above shows the Standard Oil refinery in 1911 in Richmond, Calif., now owned and operated by the Chevron Corportation.